Losing Control Over Risk Starts With One Mistake: The €400K Challenge

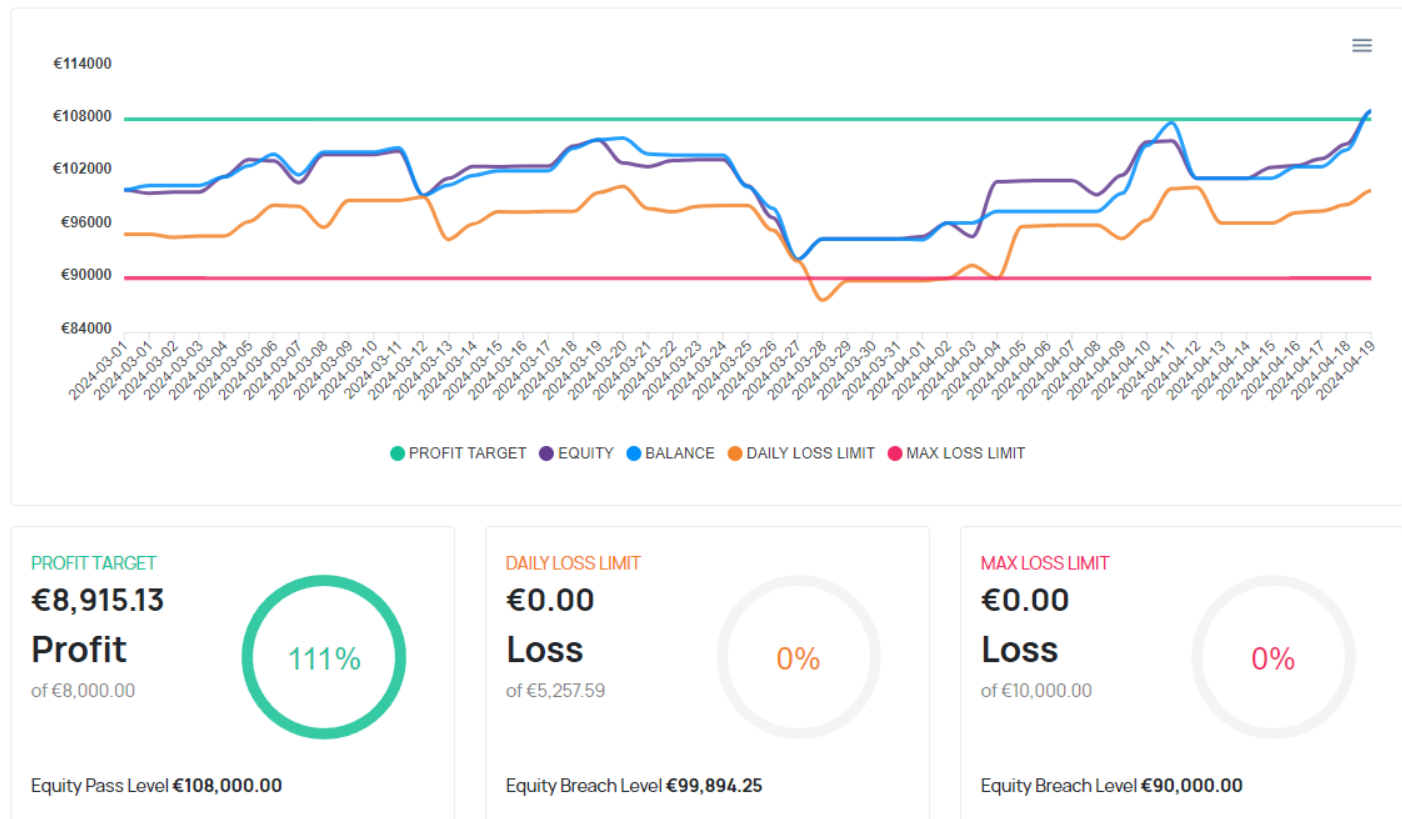

Passing a Two-Phase Verification Is No Walk in the ParkEspecially when our imagination is fueled by the possibilities offered by the largest available ProTrader account in Fintokei.A perfect example is one of my previous challenges on a €100K account, where the verification for the first phase alone lasted a staggering 49 days. Even though I eventually passed, I was "taken for a ride" three times.It was those setbacks that motivated me to describe the most common mistakes traders make.

At that time, I pointed out the "demons" that often accompany me in trading: rushing something that should naturally result from consistently executing my plan, unnecessarily getting too close to the daily loss limit—something that then needs to be recovered, which is far from easy—and excessive trading activity.

Excessive Trading Activity

This is where I need to pause. Excessive trading has the potential to derail our entire plan, disrupt our focus, and corner us—entirely by our own doing. Very often, it comes hand in hand with the urge to speed things up. After all, isn’t achieving 30% of the target in two weeks a satisfying result? Of course, it is. But that’s precisely when relaxation sets in, accompanied by a false sense of security: "Now I can push harder."

Sure, I can push harder. The problem begins when oversized positions come into play, and once the account returns to the starting point, we find ourselves unable to close those positions.

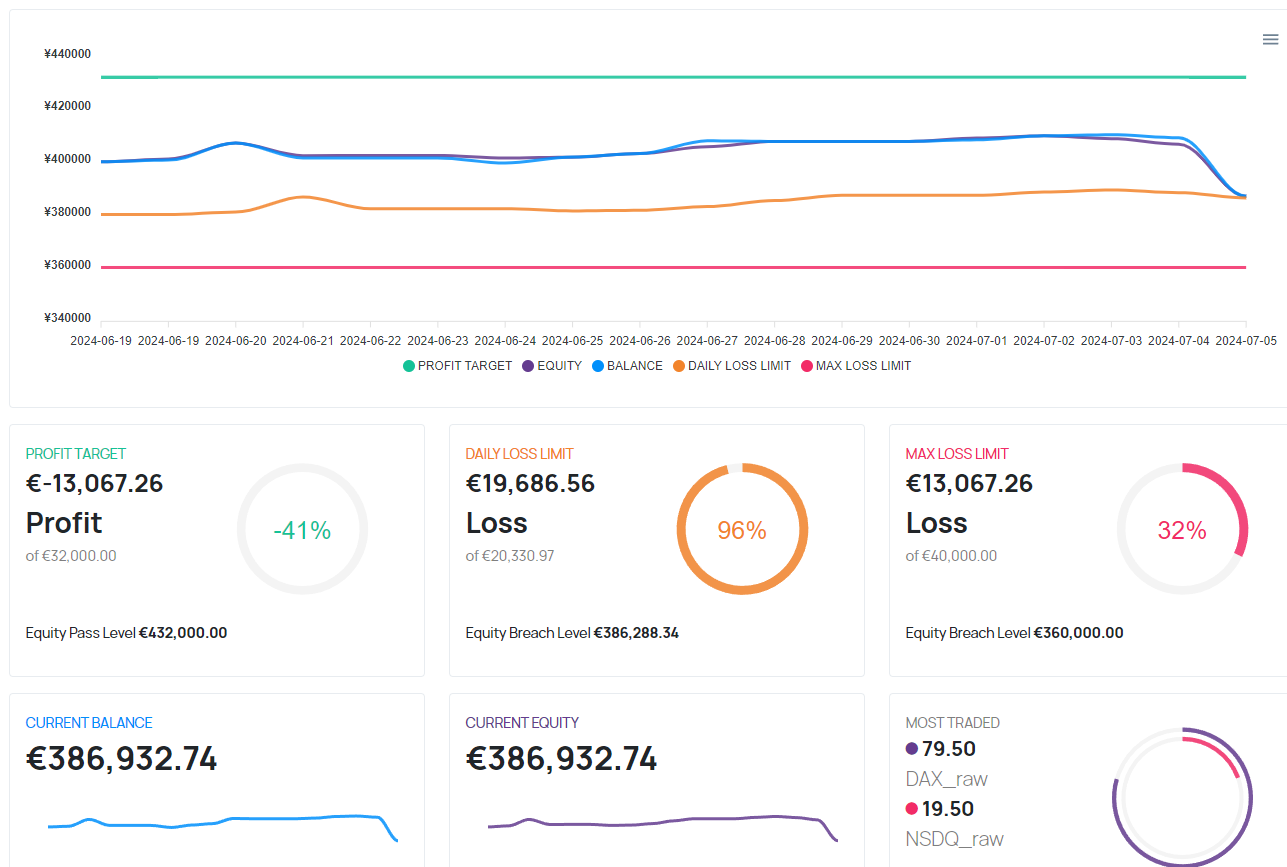

As of today, the €400K challenge account looks as follows: due to the proximity to the daily loss limit, I shouldn’t take any trades today. Pushing closer to that threshold is a razor’s edge I must avoid.

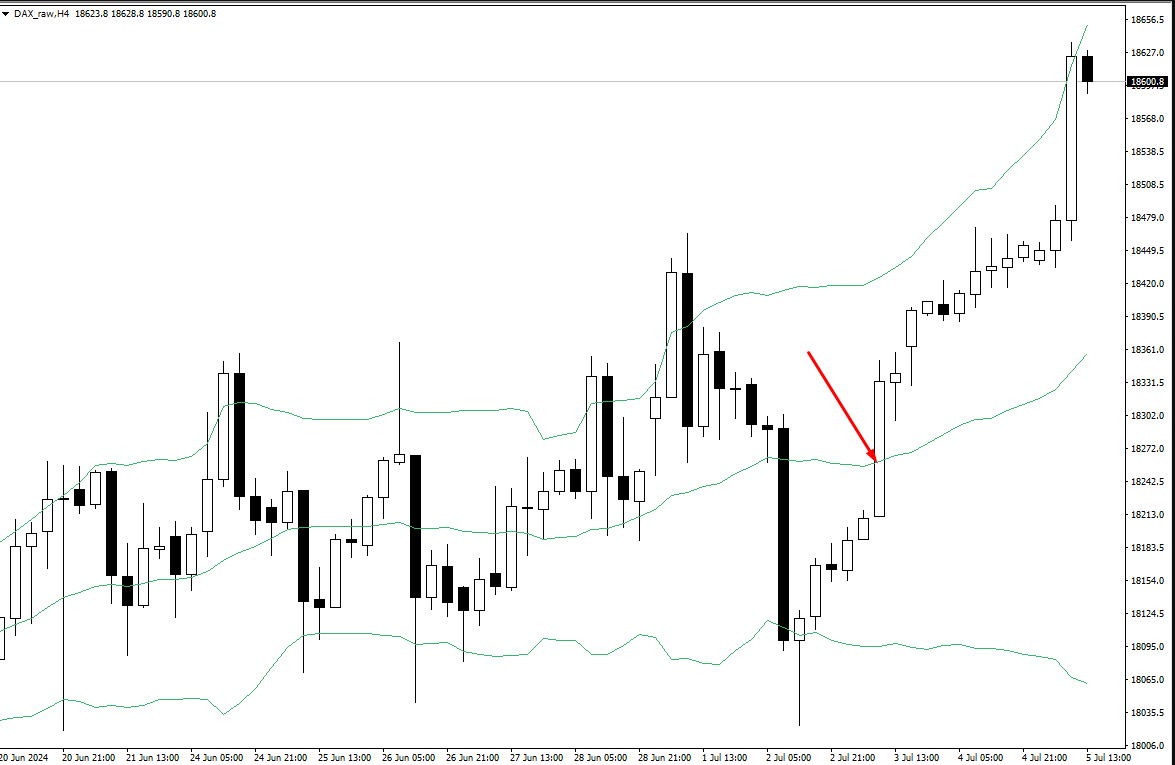

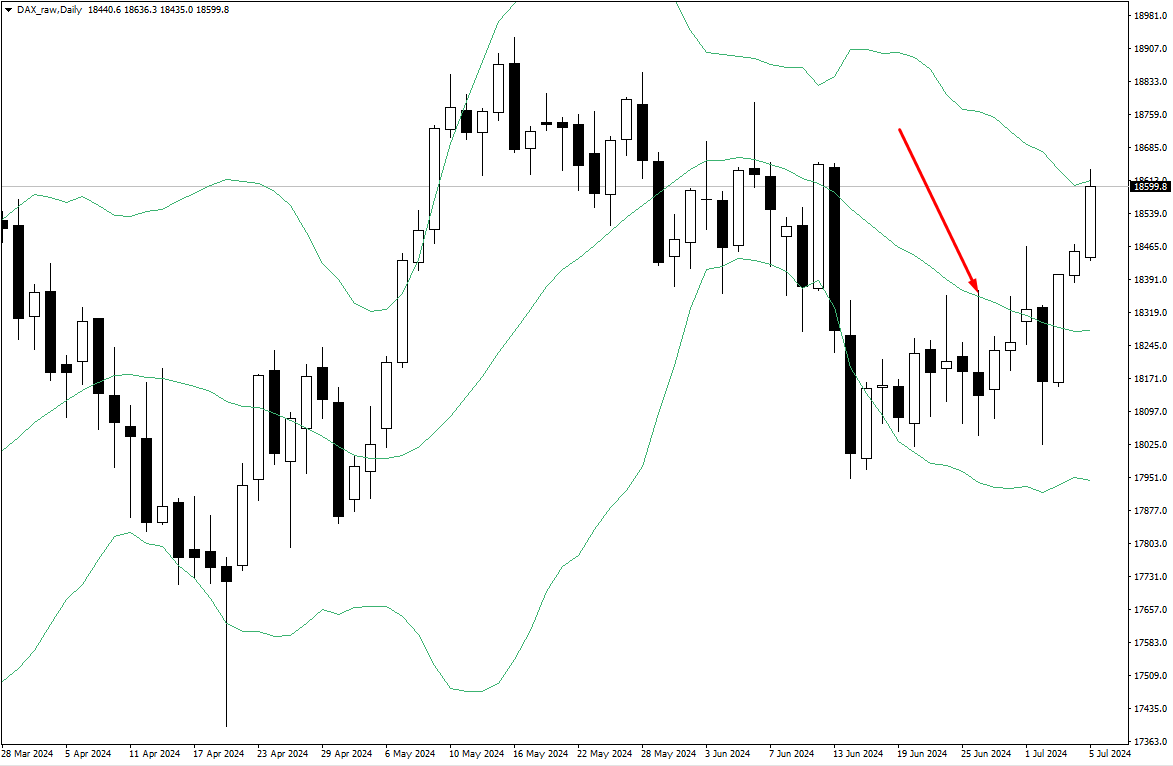

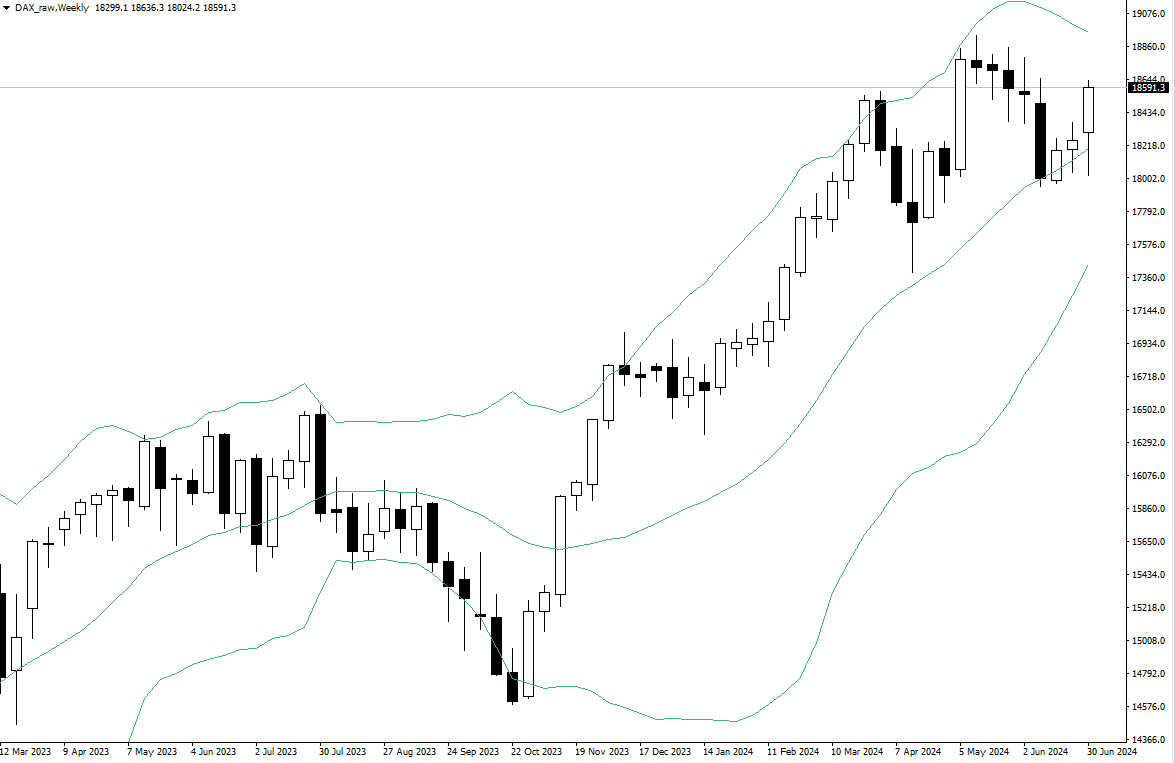

A Technical Perspective on the DAX

From an intraday perspective, since Wednesday, we haven’t observed any clear bearish structure.

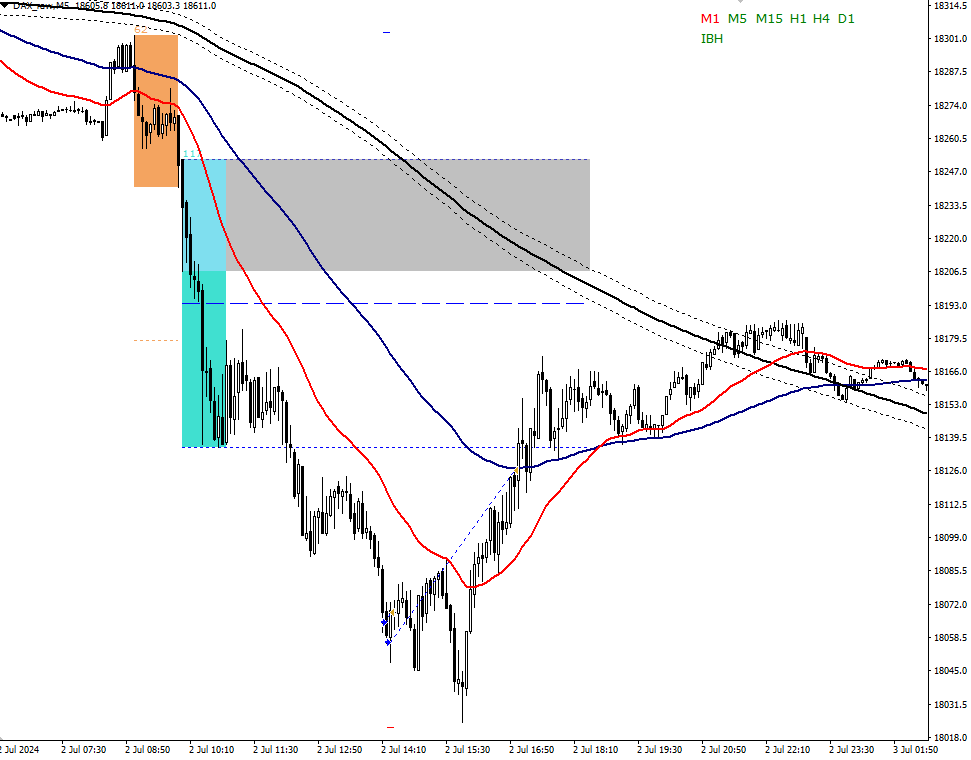

Thursday’s session – one mistake that triggered an avalanche.

Where should the SL have been placed in this situation for the long positions that I reversed?

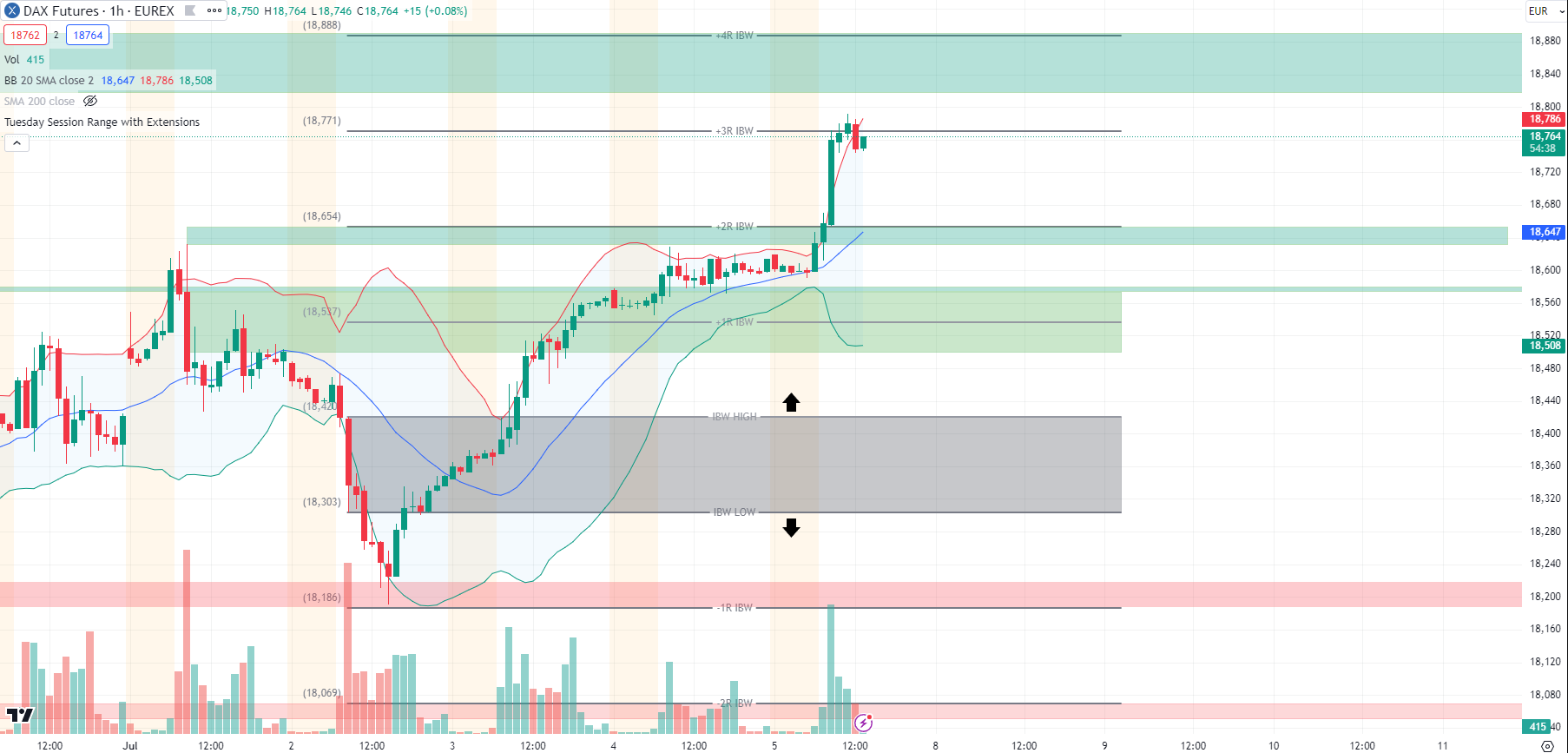

It should have remained where it was—just below IBL—or, with a more open approach, below IBL89. This is especially true given the awareness of the bullish Bollinger Bands (BB) and weekly IBW structures.

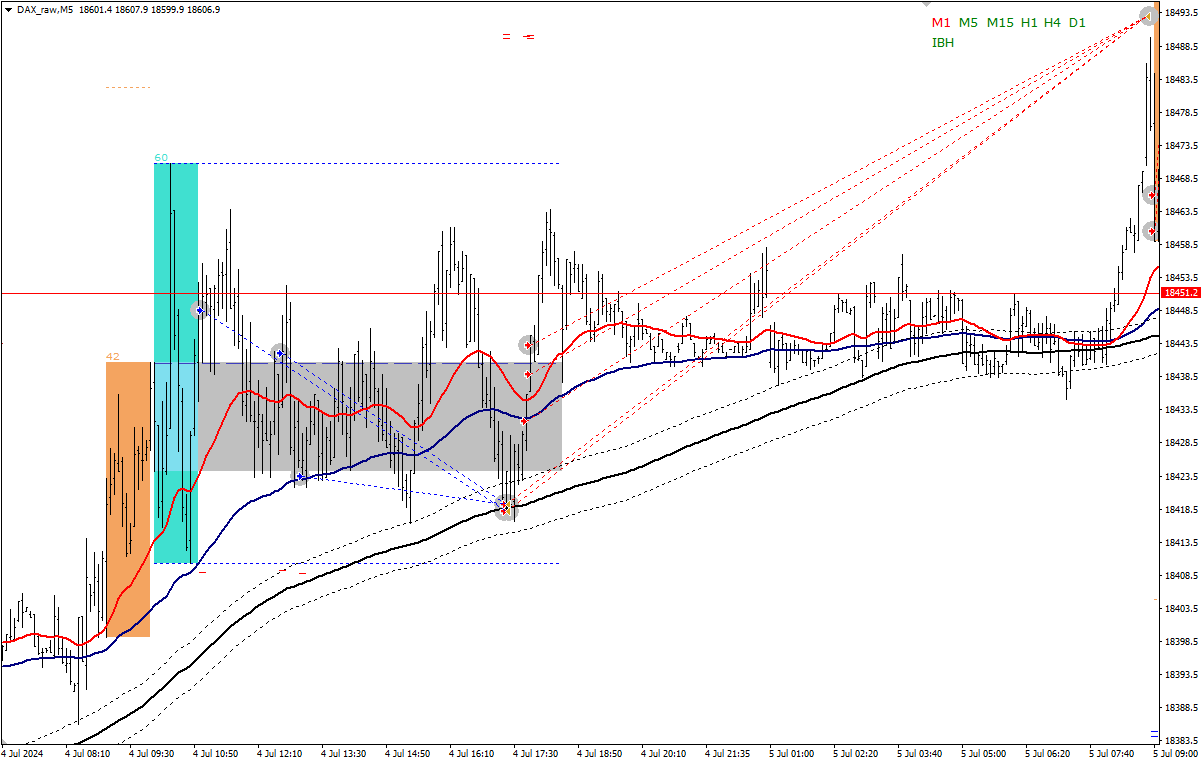

The market often gives another chance.

Not always, but the market very often allows us to correct our mistakes. If they weren’t too costly and we aren’t in berserker mode, we might be able to take advantage of it—today, I couldn’t.

Returning to yesterday’s session and that one mistake that toppled my entire plan.

Amid directional structures from higher timeframes, I had no right to take those short positions. Only long positions were permissible. Yet, I sold the lows twice.

Sometimes, we tend to get overconfident and allow ourselves far more on the market than we should. Such situations are necessary to bring us back to reality. The key is to draw lessons from them and translate those into the final result of our efforts.

I have no doubt that this challenge will be completed, but ending the week this way is far from enjoyable.

The only thing I regret and am angry at myself for is not finishing the week at the breakeven point but instead letting the account slip to a -3.3% loss.